MCX Commodity

MCX India, also known as the Multi Commodity Exchange of India Ltd., is a leading commodity derivatives exchange in India. It was established in 2003 and is headquartered in Mumbai. MCX provides a platform for trading in a wide range of commodities, including metals, energy, agricultural commodities, and more.

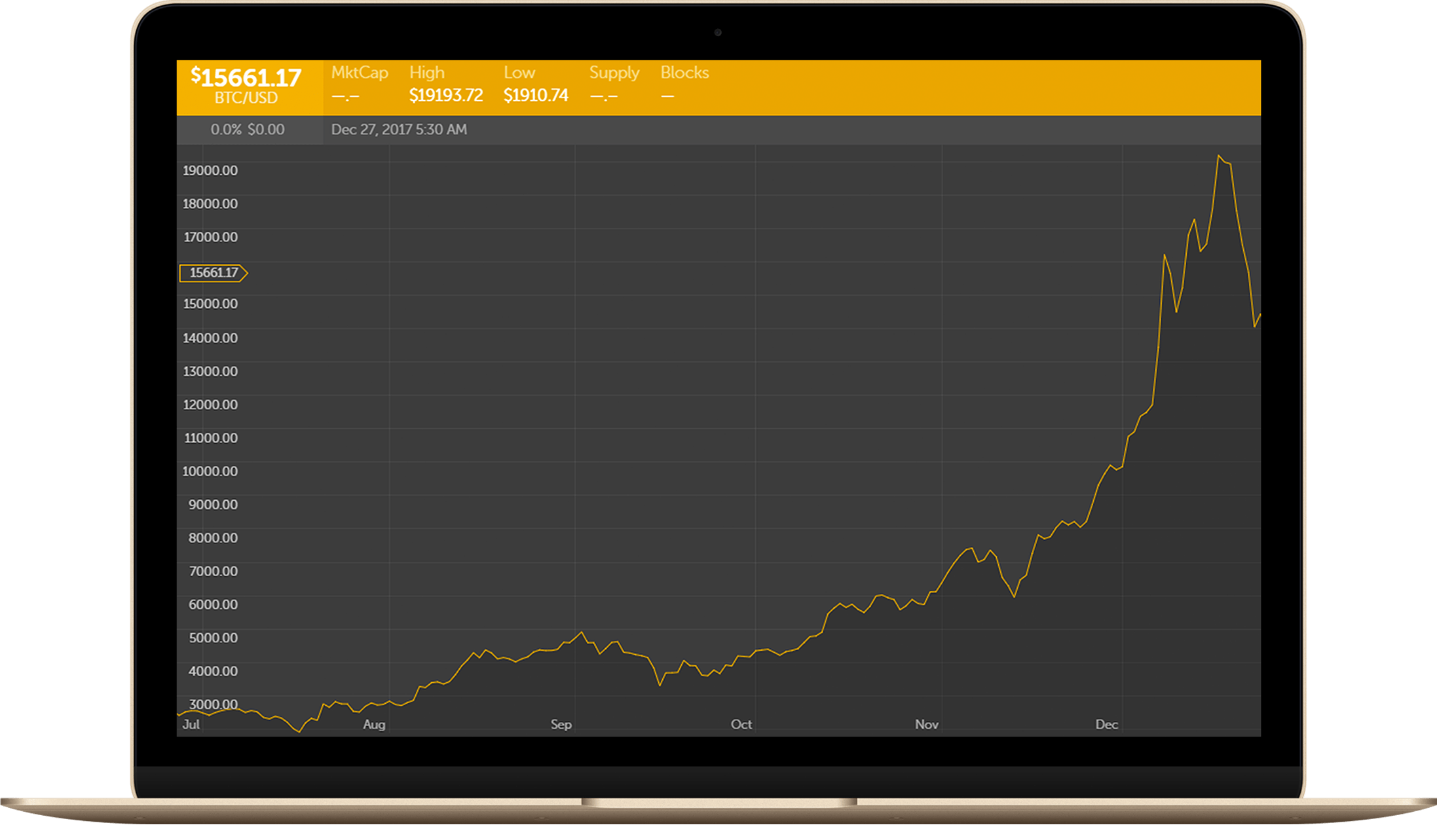

Trading: MCX offers futures trading in over 50 commodities, including gold, silver, crude oil, natural gas, copper, zinc, cotton, soybean, and many others. These commodities are traded in the form of futures contracts with specific expiry dates.

Electronic Trading Platform: MCX operates through a robust electronic trading platform, which provides real-time market data, trading facilities, risk management systems, and settlement mechanisms. The exchange follows a transparent and regulated trading environment.

MCX

MCX (Multi Commodity Exchange) is a popular platform for trading commodities in India. There are several reasons why traders choose MCX for trading:

Liquidity

MCX is known for its high liquidity, which means there is a significant volume of trading activity and buyers/sellers available for most commodities. This ensures that traders can enter and exit positions quickly at competitive prices, reducing the risk of slippage and maximizing trading opportunities.

Regulated and transparent

MCX is a regulated exchange governed by the Securities and Exchange Board of India (SEBI). It ensures transparency in trading practices, market surveillance, and investor protection. Traders can have confidence in the integrity of the market and the safety of their investments.

Wide range of commodities

Wide range of commodities: MCX offers a diverse range of commodities for trading, including gold, silver, crude oil, natural gas, copper, zinc, agricultural products, and more. This allows traders to have exposure to different markets and diversify their investment portfolios.